Probate is a topic which we have covered in some of our family law articles in the past. In many cases, people will only be granted probate if they have paid inheritance tax. However, many people in this situation may wish to be granted probate before they pay inheritance tax in order to know what they are owed.

Lots of clients in this situation believe that they don’t need to consider paying inheritance tax until they get the inherited money, which is not the case. Quite rightly, you might say, clients will often make the argument ‘ I haven’t received any money; how can I pay inheritance tax’?. This seems to be a ‘circular’ problem. Nevertheless, this is the way the system works in England and Wales. We will go into detail about some of the ways in which you can afford the inheritance tax fee later on in the article.

What is probate?

As a reminder of what probate is – in England and Wales, probate refers to the legal and financial process involved in dealing with a person’s property, money and belongings (called assets or estate) after their death. It is a legal document and confirms who has the authority to administer the estate of the deceased.

Put simply, before you can execute the deceased family estate, you need to go through the statutory process to obtain a probate. Once you receive your probate, you will have the legal right to take the actions specified in the will to enforce the assets of a loved one who has tragically passed away.

For example, an executor can close a bank account, sell a deceased person’s property, sell stock, transfer property to a beneficiary, or close an investment account.

Inheritance tax has to be paid before probate is granted in the case of an estate which is subject to inheritance tax.

So, when is an estate subject to inheritance tax?

When it comes to inheritance tax, estates worth more than £325,000 are generally subject to estate tax. If the total value of the deceased’s estate, including gifts over the past 7 years, is more than £325,000, you will need to pay estate duty to HM Revenue and Customs (HMRC). You will also need to organise the payment of estate duty using Form IHT400. The standard inheritance tax rate is 40%, which is charged on the part of the estate that’s above the tax-free threshold of £325,000.

You may not have to pay inheritance tax if the value of the estate is below £325,000, or if you leave everything to your spouse, civil partner, a charity or a community amateur sports club. Even if the value of the estate is below the threshold, you will still need to inform the Probate Registry about the deceased’s estate value when you are applying for a grant of representation. This is a document that confirms who has the legal authority to administer the estate.

While the threshold is usually £325,000, if you give away your home to your children (including foster, adopted or step-children) or grandchildren then you might get an additional tax free threshold. This is called the residence nil rate band. For the current tax year, this additional threshold is £175,000, which brings the total threshold up to £500,000. Your threshold can also be altered if you are married or in a civil partnership and your estate is worth less than the threshold, as the unused threshold can be added to your partner’s threshold when you die. There are also certain inheritance tax exemptions and relief available, therefore professional advice may help.

Inheritance tax is paid before the application for probate

The probate process generally follows 5 steps: registering the death, identifying assets and liabilities and ascertaining estate values, inquiry and payment of inheritance tax, submitting an application for probate, and paying the probate fee. The inquiry and payment of inheritance tax generally comes before the submission of an application for probate. Read our article for more information about probate process by clicking here.

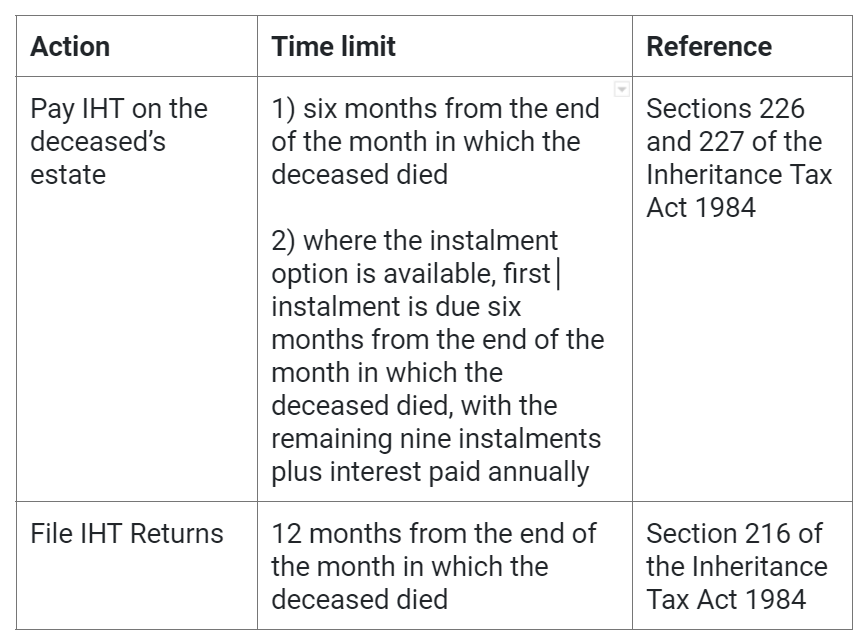

Time limits on the payment of inheritance tax

Please see the below table for time limits when it comes to payment of inheritance tax before probate is granted.

In practice, after HMRC confirms the IHT is cleared, HMRC will issue the IHT receipt to the Probate Registry directly (not to the payee). Once the Probate Registry has the record of IHT receipt, it can proceed with the relevant probate application. Therefore, in order to obtain the grant, the personal representatives will have to pay any IHT due on the delivery of the IHT account.

Paying for inheritance tax

There are a few ways possible to fund for the IHT payment – these include: bank loans, loans from beneficiaries, direct payments to HMRC from the deceased’s bank account, in yearly instalments, or through trusts. It is much better to pay IHT as soon as you can, as HMRC will charge you interest if you do not pay the inheritance tax by the due date (the end of the sixth month after the person died). Life insurance policies can be used to pay for all or some of an inheritance tax bill by protecting your home or other assets which may need to be sold before probate is granted.

After inheritance tax is paid, if you then overpay on the amount that the estate owes, HMRC will refund you the excess after you have been granted probate, as well as any interest.

At Lisa’s Law, we understand that the death of a loved one like a relative can be a difficult time for everyone involved.

If you’d like help navigating the complexities of probate and the management of the estate, get in touch with Lisa’s Law today and the highly trained Family Law experts will be able to assist you in your time of need.

Have questions about this article? Get in touch today!

Call us on 020 7928 0276, our phone lines are open and we will be taking calls from 9:30am to 6:00pm.

Email us on info@lisaslaw.co.uk.

Use the Ask Lisa function on our website. Simply enter your details and leave a message, we will get right back to you: https://lisaslaw.co.uk/ask-question/

Or, download our free app! You can launch an enquiry, scan over documents, check progress on your case and much more!

I used to be able to find good info from your blog posts.

I know this if off topic but I’m looking into starting my own weblog and was wondering what all is required to get setup?

I’m assuming having a blog like yours would cost a pretty penny?

I’m not very internet smart so I’m not 100% positive. Any suggestions or advice

would be greatly appreciated. Thanks

Unquestionably believe that which you said. Your favourite justification seemed to

be on the net the easiest thing to be mindful of.

I say to you, I definitely get annoyed at the same time as people consider worries that they plainly don’t recognize about.

You controlled to hit the nail upon the

highest and outlined out the entire thing without having side-effects

, people can take a signal. Will likely be back to get more.

Thank you