As a company which values a strong team spirit and cross-department collaboration, our regular work socials are a great opportunity to get together and stay connected as a team beyond our day-to-day work. With hybrid and remote working now the norm for many of us, these in-person moments are more important than ever.

Our last two socials were especially eventful, with our Easter social event taking place at Fairgame in Canary Wharf and our recent Summer social being hosted at Bounce in Shoreditch.

As the name suggests, Fairgame features fairground style games under one roof. Colleagues competed against each other across the variety of games to achieve the highest score, with prizes for especially high scores on offer!

Meanwhile, at Bounce we had our own private area with several ping pong tables. Our excellent hosts ran a doubles tournament where teammates where randomly allocated, giving further opportunities for team-building.

A big thanks to our social committee who take the time out to find the best venues possible. As a company of nearly 70 which continues to grow, this isn’t always easy. Further gratitude also has to also be given to the staff who have hosted us at all of our socials.

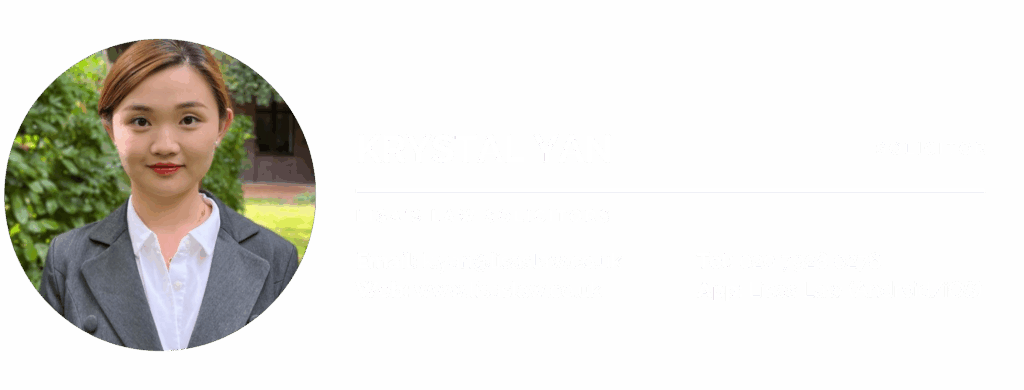

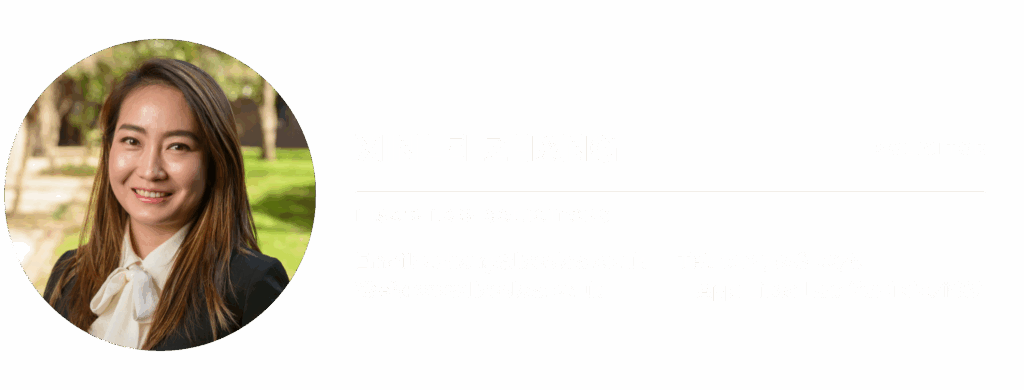

We look forward to our next social event! Here are a few pictures across both events.

Have questions? Get in touch today!

Call our office on 020 7928 0276, we will be taking calls from 9:30am to 6:00pm.

Email us on info@lisaslaw.co.uk.

Or, use the contact form on our website. Simply enter your details and leave a message, we will get right back to you: https://lisaslaw.co.uk/contact/

For more updates, follow us on our social media platforms! You can find them all on our Linktree right here.