This blog will outline the latest guidance related to the higher bracket of Stamp Duty Land Tax, who it applies to, and in what scenarios it does or does not have to be paid. SDLT is a topic containing many avenues, which we will explore in upcoming articles, but for this one we will mainly focus on the rules concerning for various types of people involved in such property deals.

First of all, what is SDLT?

Stamp Duty Land Tax (SDLT) is a tax on land transactions in England and Northern Ireland. Introduced as part of the Finance Act 2003, it largely replaced stamp duty with effect from 1 December 2003. SDLT is not a stamp duty, it is more of a self-assessed transfer tax charged on “land transactions”.

The SDLT Holiday is coming to an end!

The current SDLT holiday started on 8th July 2020. During the holiday period, people buying a residential property or piece of land in England or Northern Ireland do not need to pay any SDLT for the first £500,000 of their purchase price, if they do not own other residential properties on the date of purchase. If they do have other residential properties, they normally need to pay 3% of SDLT on the first £500,000 of their purchase price. This is ending on 31 March 2021. Afterwards, the SDLT rates applied prior to 8th July 2020 will resume. Some rates will be higher than others, and it mainly depends on the value of the property being purchased.

Relief remains for first time buyers

From 1 April 2021, first-time buyers may still be eligible for relief. These new home-owners will pay no tax for the first £300,000 of their purchase price if both the following apply:

- They, and anyone else they are buying with are both first-time buyers

- the property they are buying is valued at £500,000 or less

So, these first-timers can breathe a sigh of relief!

Note: First time buyers purchasing property for more than £500,000 will not be entitled to any relief and will pay SDLT at the normal rates.

The higher rates

The higher SDLT rates , generally speaking, apply to people who already own one or more properties.

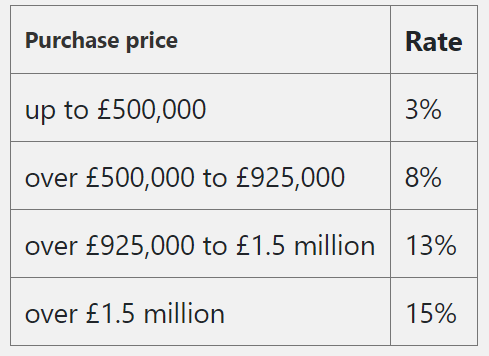

The higher rates from 8 July 2020 to 31 March 2021

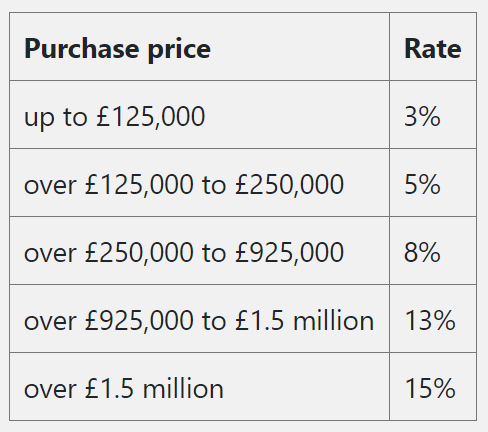

The higher rates from 1 April 2021

These rates also apply if you bought a property before 8 July 2020.

These are not small amounts of money. For example, let’s say you purchase a property for £340,000 – the SDLT charge will be £27,200!

Who do these rates apply to?

It all depends on each person’s particular circumstances. If you are purchasing a property and you already own a separate one, it is likely that you will have to pay the higher SDLT rates. This is the general position; however, the following special rules are worth noting:

Properties owned by your spouse

They will be treated as owned by you as well, unless you have been separated from your spouse for a long time. For example, let’s say your wife owns a house which is worth £450,000 while you currently own no property. If you decide to purchase a house, it is likely that the higher rates of SDLT will apply to you, as in such situation, you will be deemed as having owned a property of £450,000.

The same rule will apply if you and your spouse buy a property together. You both need to pay the higher rate of SDLT to the whole house, not the share you are supposed to own in it.

Purchasing properties with someone else

The above rule also applies to the scenario where you buy properties with someone else, rather than your spouse, for example, a friend. If either of you has already owned a residential property/properties, you both need to pay the higher rate of the tax regarding the whole property.

In addition, this rule even extends to the relevant party’s spouse. For example, if you decide to buy a property with a friend. He does not own any residential property, but his wife owns one. Both you and your friend need to pay the higher rate in relation to the new property you are buying.

Therefore, next time, if you decide to purchase properties with friends, you should only ask them whether they have properties, you also need to ask whether their spouse have properties as well; otherwise, you may end up paying much more SDLT than you have expected!

Replacing your current home

In cases where you are replacing your current home, meaning when everything is finalised, you only have one main residence, and do not own another property simultaneously, these higher rates may not apply.

However, if you have not sold or given away your previous main residence on the day you complete your new purchase you will likely have to pay higher rates. This is because you will own 2 properties by the end of your new purchase.

If you sell your old home within 36 months of acquiring the new one, you can apply for a refund of the higher SDLT rate you have paid regarding your new property.

Inheriting a property

SDLT will not usually apply if you inherit a property as part of someone’s will, or as a gift. However, other charges such as inheritance tax may apply. This is similar if you are transferred a house after a divorce or end of a civil partnership, the higher rates of SDLT may not apply in this case.

Have questions? We are operating as usual!

We are ready to provide you with a fantastic legal service and there are many ways for you to contact us!

Call us on 020 7928 0276, phone calls are operating as usual and will be taking calls from 9:30am to 6:00pm.

Email us on info@lisaslaw.co.uk.

Use the Ask Lisa function on our website. Simply enter your details and leave a message, we will get right back to you: https://lisaslaw.co.uk/ask-question/

Or, download our free app! You can launch an enquiry, scan over documents, check progress on your case and much more!

Links to download below:

iPhone: https://apps.apple.com/us/app/lisas-law/id1503174541?ls=1

Android: https://play.google.com/store/apps/details?id=com.lisaslaw