We have some fantastic roles available in our busy, London based law firm. Despite the challenges that the COVID-19 pandemic has brought, business has continued to grow here at Lisa’s Law and we are pleased to say that now is a good time to recruit some new team members!

Working at Lisa’s Law

Lisa’s Law is a forward-thinking, modern law firm. We value each member of the team highly and welcome their contributions and ideas. Career development is of paramount importance to us. We endeavour to create a relaxing and friendly work environment and provide every opportunity for colleagues to learn, develop and lead.

Now is a great time to join us! So, what positions are on offer?

All positions will be full-time and based at our offices in the SE1 area, near Elephant and Castle station, and Waterloo station. Working from home can also be discussed during the application process.

Solicitor and Paralegal roles:

We are looking for qualified solicitors or experienced paralegals with experience of handling a wide range of legal matters in Immigration, Litigation and or Conveyancing. They would be of a commercial mind-set with excellent communication skills, both written and verbal and possess the skills and potential to contribute to our growing success.

Your responsibilities will include but are not limited to the following:

- Manage your own caseload.

- Provide a high-quality legal service to clients.

- Meet and interview clients and take clients’ instruction.

- Advise clients on the law and legal issues relating to their case.

- Supervise junior paralegals, trainees and legal assistants.

- Draft documents, letters and contracts tailored to client’s need.

- Keep up to date with changes and developments in the law.

The ideal candidate will have the following attributes:

- Excellent English and Chinese language skills both verbal and written.

- At least 3 years’ experience in Immigration, Litigation and or Conveyancing.

- Proven ability to manage a large caseload and work to tight deadlines.

- Good attention to detail and personal organisation skills.

Salary between £30,000 and £50,000 dependent on experience.

To apply for this role email your CV and cover letter to a.dalipe@lisaslaw.co.uk or apply through this link.

Chinese Speaking Conveyancer

We are looking for candidates with experience of handling a wide range of commercial and residential conveyancing matters including freehold and leasehold conveyancing, landlord advice and disputes, land disputes and joint ownership. They would be of a commercial mind-set with excellent communication skills, both written and verbal and possess the skills and potential to contribute to our growing success.

Your responsibilities will include but are not limited to the following:

- Manage your own caseload.

- Provide a high-quality legal service to all clients.

- Meet and interview clients and take clients’ instruction.

- Advise clients on the law and legal issues relating to their case.

- Supervise junior paralegals, trainees and legal assistants.

- Draft documents, letters and contracts tailored to client’s need.

- Keep up to date with changes and developments in the law.

The ideal candidate will have the following attributes:

- Excellent English and Chinese language skills both verbal and written.

- At least 3-years’ experience handling commercial and residential conveyancing matters.

- Proven ability to work under heavy workload and to tight deadlines.

- Experience of handling large caseloads.

- Good attention to detail and personal organisation skills.

Salary between £25,000 and £50,000 dependent on experience.

To apply for this role email your CV and cover letter to a.dalipe@lisaslaw.co.uk or apply through this link.

Immigration Supervisor

We are looking to recruit an experienced immigration supervisor with extensive experience of handling a wide range of immigration matters. They would be of a commercial mind-set with excellent communication skills, both written and verbal and possess the skills to contribute to our growing success.

Your responsibilities will include but are not limited to the following:

- Develop, market and grow the immigration department.

- Day to Day supervision of the immigration department ensuring that they maintain high standard of service; maintain practice standards; resolve any compliance matters; meet expected targets.

- Provide regular updates and internal training to the immigration department.

- Identify new business opportunities.

- Optimise and streamline the department’s procedures.

- Stay up-to-date with the latest relevant legislation and policy changes.

- Conduct regular file reviews of all immigration colleagues.

The ideal candidate will have the following attributes:

- Excellent Chinese language skills both verbal and written is preferable.

- Extensive experience in appeal, JR, bail, EEA, PBS and HR applications.

- At least 3 years’ supervisory experience.

- Proven ability to work under heavy workload and to tight deadlines.

- Good attention to detail and personal organisation skills.

Salary £70,000+, dependant on experience.

To apply for this role email your CV and cover letter to a.dalipe@lisaslaw.co.uk or apply through this link.

Litigation Supervisor

We are looking to recruit an experienced Litigation supervisor who is a three year post qualified solicitor with extensive experience of handling a wide range of contentious issues including commercial, civil and property litigation. They would be of a commercial mind-set with excellent communication skills, both written and verbal and possess the skills to contribute to our growing success.

Your responsibilities will include but are not limited to the following:

- Develop, market and grow the Litigation department.

- Day to day supervision of the Litigation department ensuring that they maintain high standard of service; maintain practice standards; resolve any compliance matters; meet expected targets.

- Provide regular updates and internal training to the Litigation department.

- Identify new business opportunities.

- Optimise and streamline the department’s procedures.

- Stay up-to-date with the latest relevant legislation and policy changes.

- Conduct regular file reviews of all immigration colleagues

The ideal candidate will have the following attributes:

- Excellent Mandarin language skills both verbal and written is preferable.

- Extensive experience in handling Litigation cases.

- At least 3 years’ supervisory experience.

- Proven ability to work under heavy workload and to tight deadlines.

- Good attention to detail and personal organisation skills.

Salary £70,000+, dependant on experience.

To apply for this role email your CV and cover letter to a.dalipe@lisaslaw.co.uk or apply through this link.

Have questions? We are operating as usual!

We are ready to provide you with a fantastic legal service and there are many ways for you to contact us!

Call us on 020 7928 0276, phone calls are operating as usual and will be taking calls from 9:30am to 6:00pm.

Email us on info@lisaslaw.co.uk.

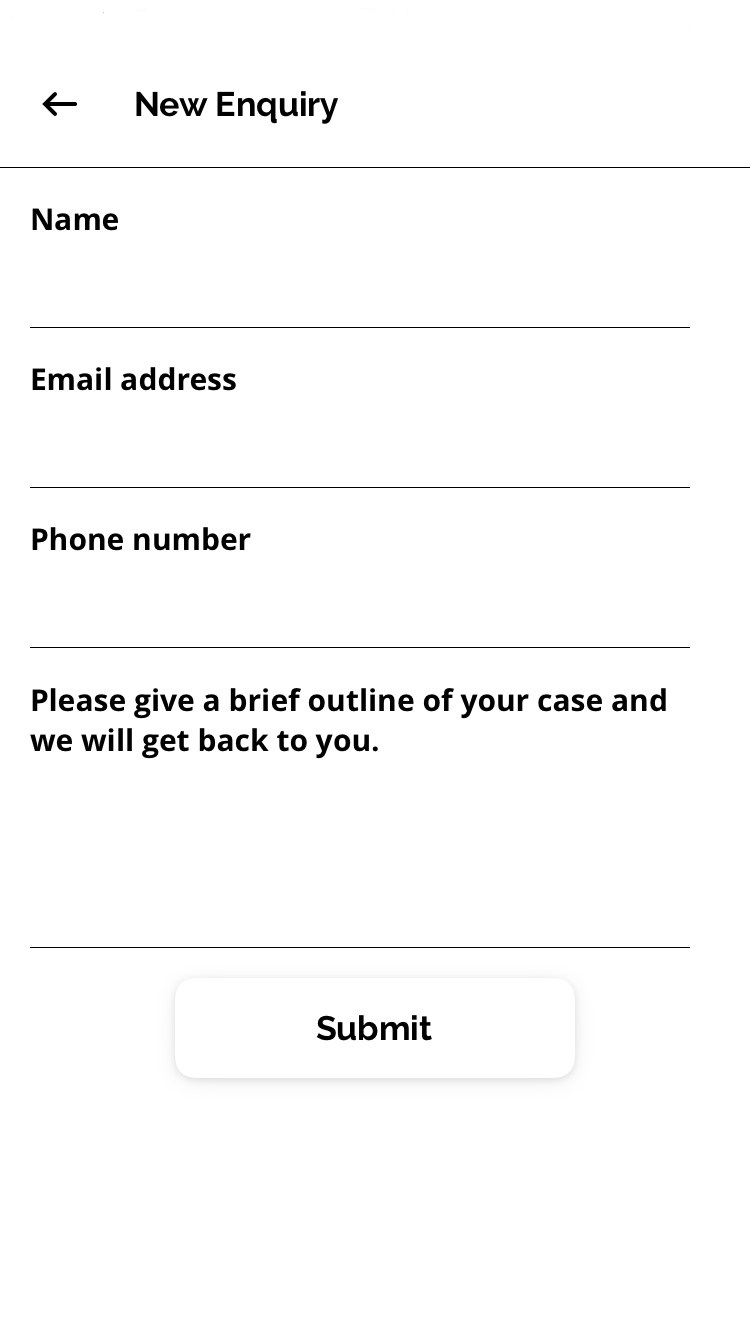

Use the Ask Lisa function on our website. Simply enter your details and leave a message, we will get right back to you: https://lisaslaw.co.uk/ask-question/

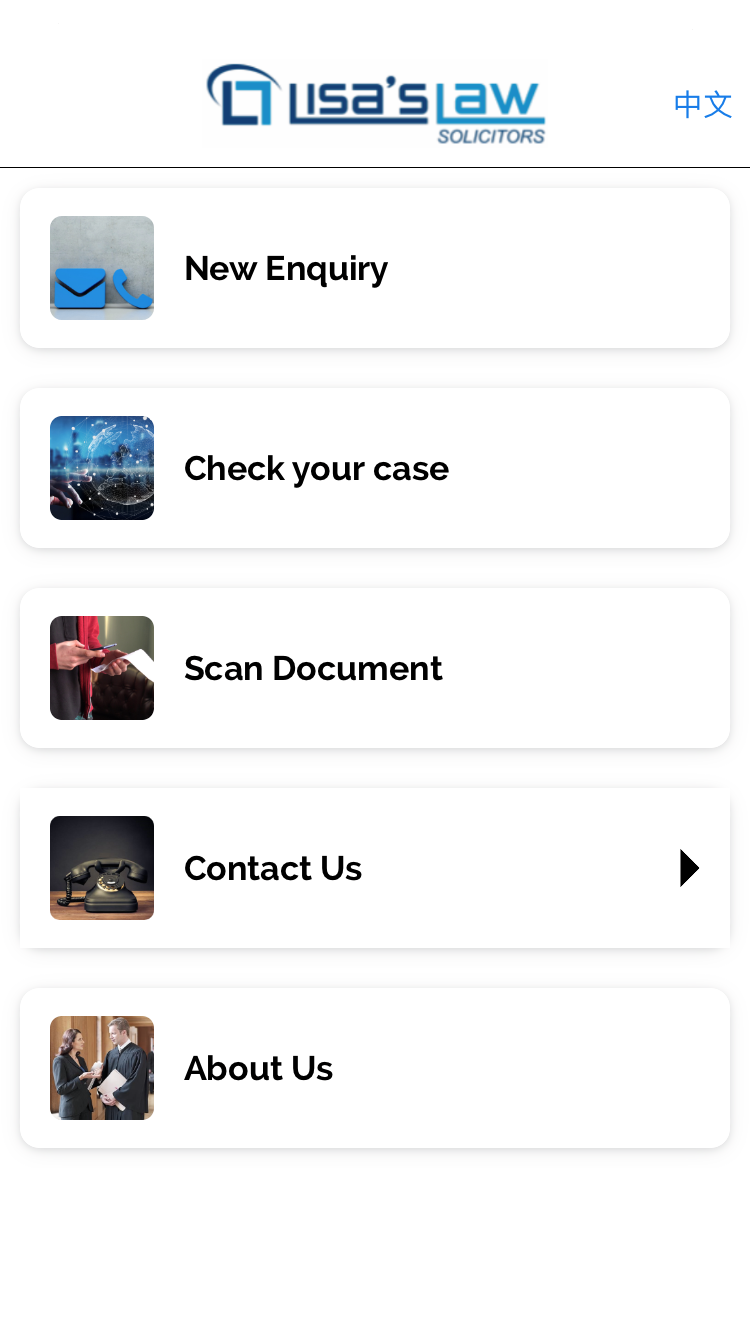

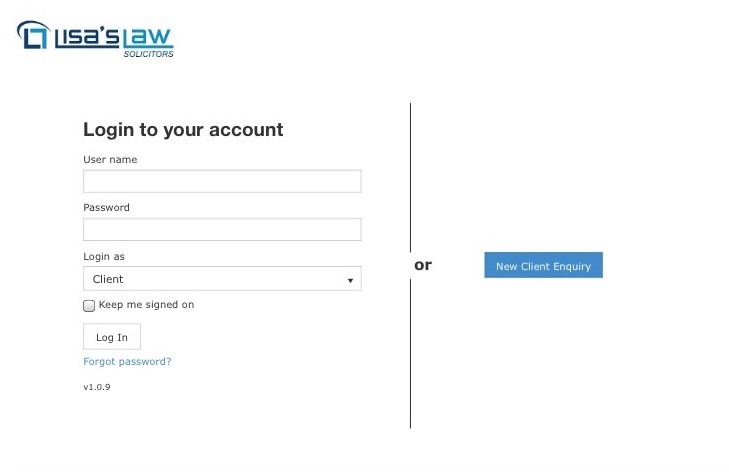

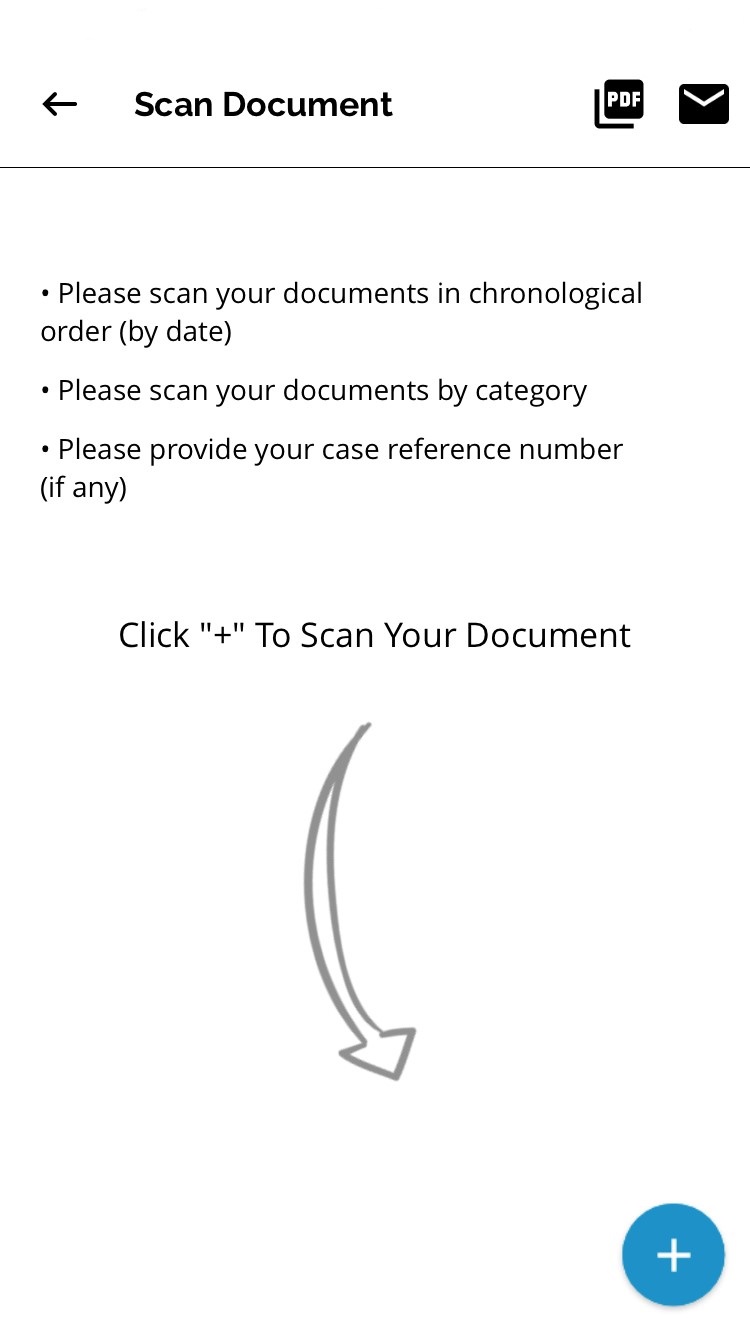

Or, download our free app! You can launch an enquiry, scan over documents, check progress on your case and much more!

Links to download below:

iPhone: https://apps.apple.com/us/app/lisas-law/id1503174541?ls=1

Android: https://play.google.com/store/apps/details?id=com.lisaslaw