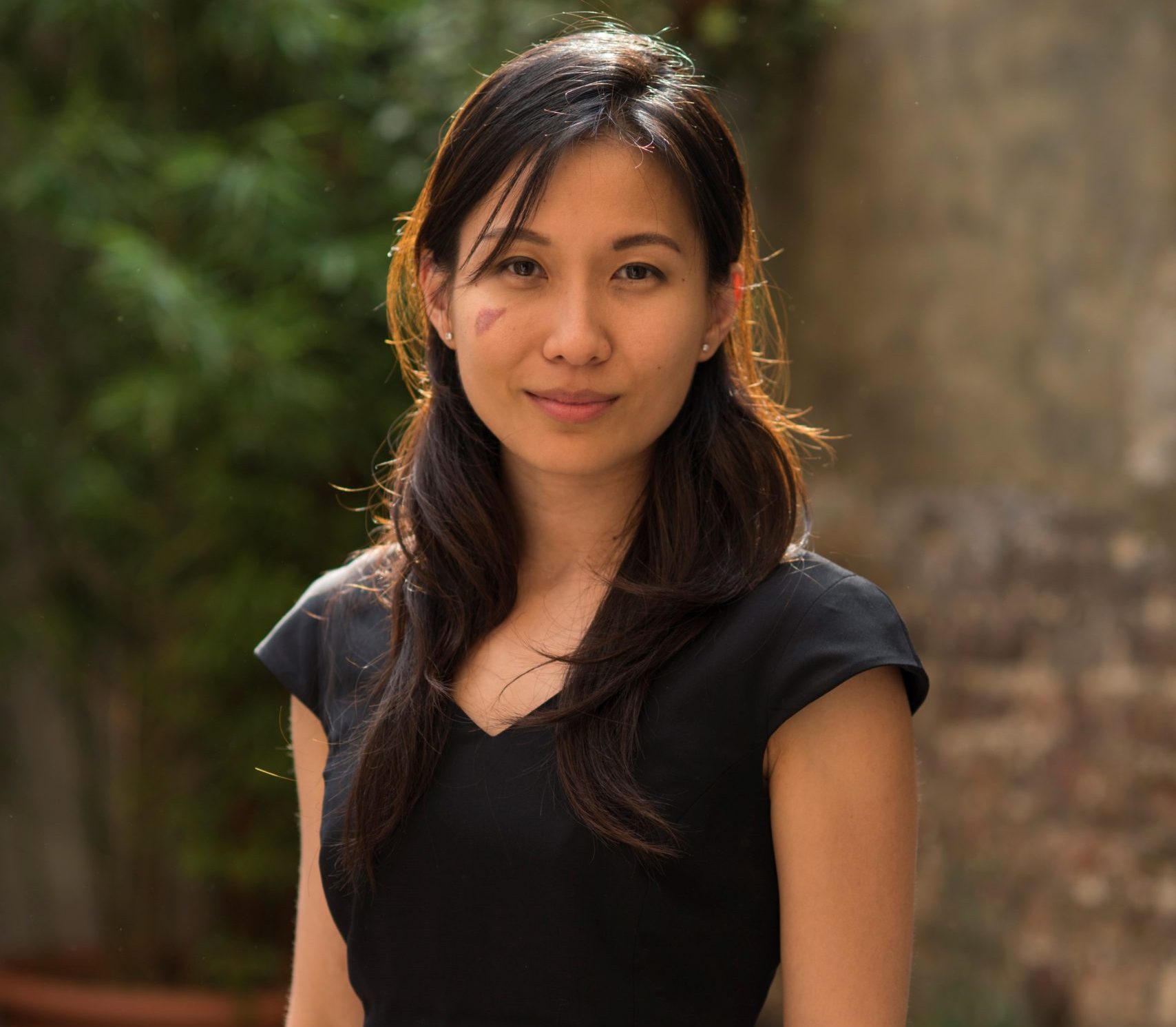

We are excited to welcome Victor Mmegwa to Lisa’s Law. Victor joins the Immigration Team as a Solicitor and we are very pleased to have him on board.

Victor has 6 years PQE (post-qualified experience) and has huge experience of managing his own caseload in Immigration, Human Rights and Public law. He graduated from the University of Hertfordshire in 2010 with a 2:1 in LLB (Honours) Law and successfully completed his Legal Practice Course at BPP Law School in 2012.

Victor is an Accredited Senior Caseworker (Level 2) under The Law Society Immigration & Asylum Scheme and has experience working on a range of cases from Indefinite Leave to entry clearance applications.

In his spare time, Victor likes to play either 5 a-side or 11 aside football. He also likes to work out in the form of strength training.

Victor is fluent in English.

For more articles like this, subscribe to our newsletter today.

Have questions about this article? Get in touch today!

Call us on 020 7928 0276, our phone lines are open and we will be taking calls from 9:30am to 6:00pm.

Email us on info@lisaslaw.co.uk.

Use the Ask Lisa function on our website. Simply enter your details and leave a message, we will get right back to you: https://lisaslaw.co.uk/ask-question/

Or, download our free app! You can launch an enquiry, scan over documents, check progress on your case and much more!