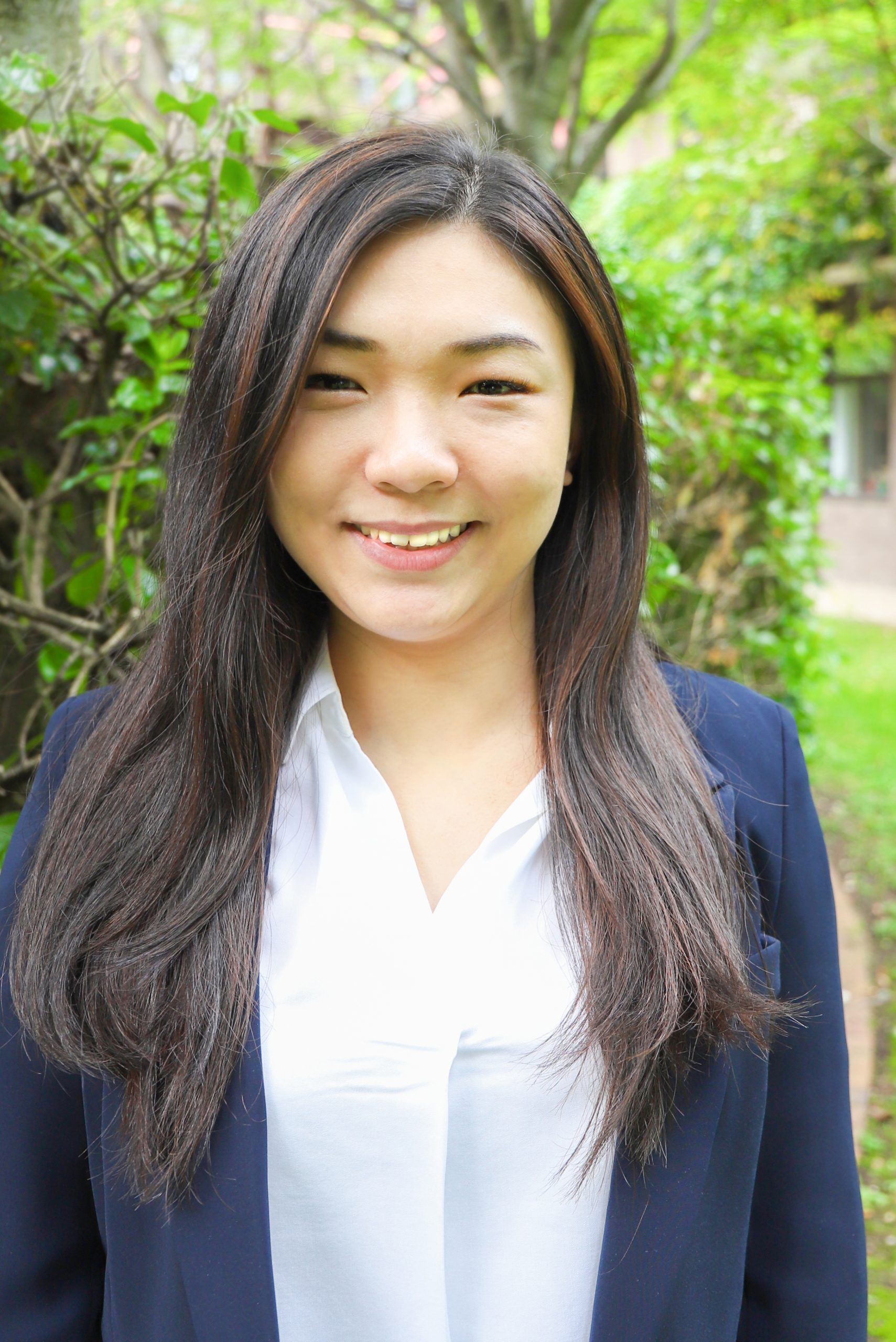

We are so thrilled to announce that Angel Yeung has joined us as a Paralegal, and has been excellent from the get go!

Angel obtained her LLB degree from East China University of Political Science and Law in Shanghai and pursued her Master’s studies at University of Bristol in 2018. Also, she is going to graduate from her LPC program at University of Law in the coming weeks.

Before joining Lisa’s Law, she had been dealing with international clients and gained experience in the field of trademark, corporate, conveyancing and immigration law in both China and the UK.

In her spare time, Angel enjoys cooking at home, playing sports with friends during weekends and travelling.

Angel speaks Mandarin, Cantonese and English fluently.

Need legal advice? We are here to help!

Call us on 020 7928 0276, phone calls are operating as usual and will be taking calls from 9:30am to 6:00pm.

Email us on info@lisaslaw.co.uk.

Use the Ask Lisa function on our website. Simply enter your details and leave a message, we will get right back to you: https://lisaslaw.co.uk/ask-question/

Or, download our free app! You can launch an enquiry, scan over documents, check progress on your case and much more!

Links to download below:

iPhone: https://apps.apple.com/us/app/lisas-law/id1503174541?ls=1

Android: https://play.google.com/store/apps/details?id=com.lisaslaw