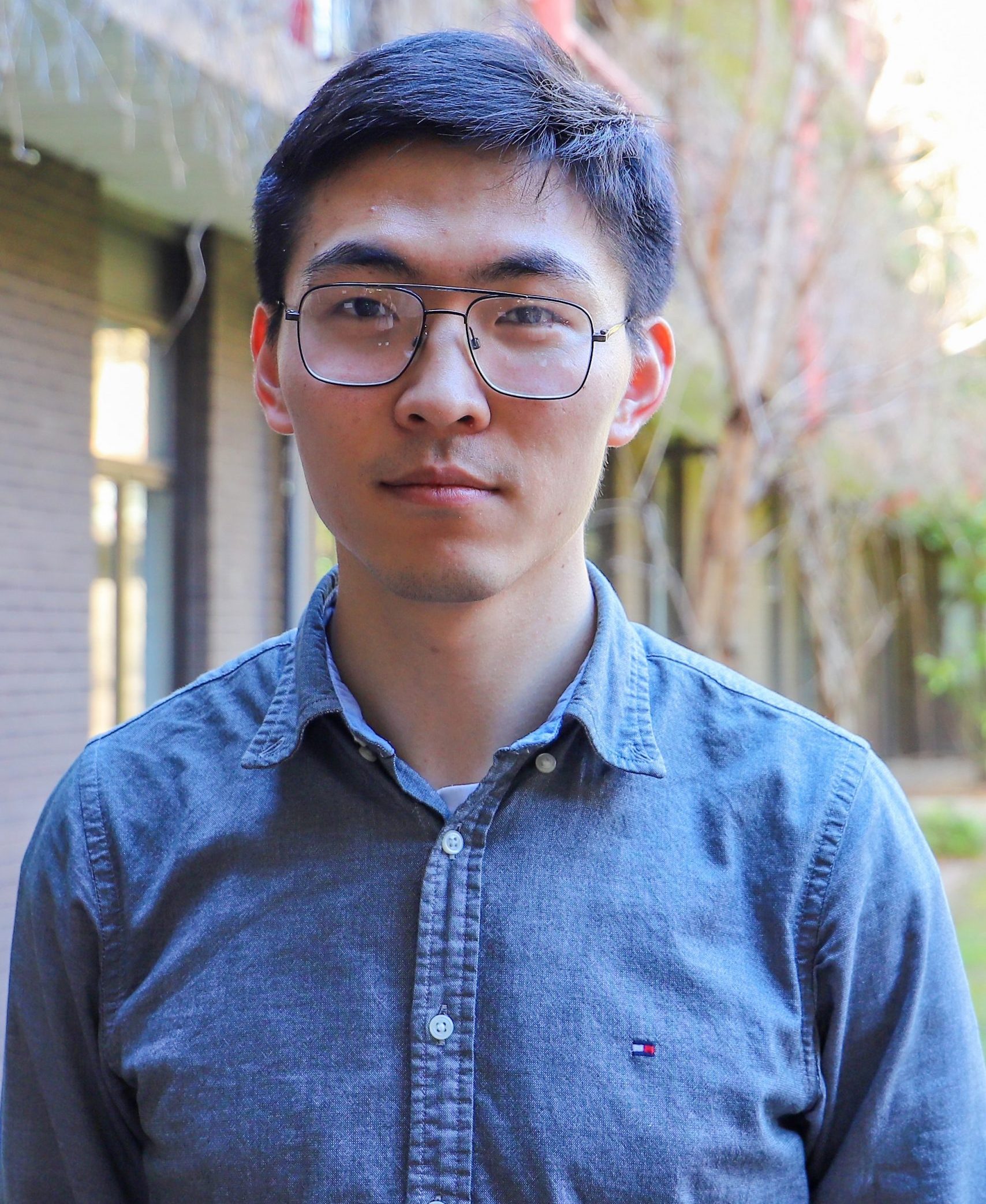

We are delighted to welcome the newest member of our team, Brian Feng. Brian joins us as an AML Administrator and has already displayed an eye for detail and shown himself to be a hardworking team player.

Brian majored in statistics at the University of Edinburgh and has previously taken part in some interesting projects in data science, including visualizing traffic maps across Scotland, modelling prices for second-hand items on eBay, and analysing the purchase history of Lego products.

He had a full-time job in the KYC team at Amazon, and has also lived and interned in Beijing and Shanghai.

Brian is fluent in Mandarin and English. He also claims to be proficient in a global language called “drinking beer” and looks forward to the opportunity to grab a pint and talk to everyone about life after work.

Besides beer, his other interests include long-distance running. He has participated in many cross-country orienteering competitions and came in third place in one of the men’s group competitions in Beijing.

He hopes to get to know everyone as soon as possible and continue to bring value to the team.

Have questions? Get in touch today!

Call us on 020 7928 0276, phone lines are open and we will be taking calls from 9:30am to 6:00pm

Email us on info@lisaslaw.co.uk.

Use the Ask Lisa function on our website. Simply enter your details and leave a message, we will get right back to you: https://lisaslaw.co.uk/ask-question/

Or, download our free app! You can launch an enquiry, scan over documents, check progress on your case and much more!